| StockFetcher Forums · General Discussion · Need some input from the forum | << 1 ... 2 3 4 5 6 ... 10 >>Post Follow-up |

| Kevin_in_GA 4,599 posts msg #112476 - Ignore Kevin_in_GA |

3/27/2013 10:15:30 AM @Eman: Agreed. I am using this as my only trading strategy right now. Like my TAA system for managing longer-term investment accounts, I am putting my money where my mouth is. |

| jackmack 334 posts msg #112477 - Ignore jackmack |

3/27/2013 4:11:06 PM Kevin I am sure it's nothing but wanted to just point it out; Filled at 91.84 on 3/27 9:30AM at market - it opened at 89.33ish Maybe as time passes since new today it will work out but it is not correct as it stands on the site currently. Thank you Cheers |

| Kevin_in_GA 4,599 posts msg #112479 - Ignore Kevin_in_GA |

3/27/2013 4:37:03 PM Not sure what you mean - I filled 50 shares today at the open price ($89.44) without issue. Essentially zero slippage. I had expected some but did not see it happen. This system uses S&P 500 stocks to minimize bid-ask spread, so hopefully that is not an issue for anyone. |

| jackmack 334 posts msg #112480 - Ignore jackmack |

3/27/2013 5:06:07 PM I just meant it is posting it on the site as the filled price is 91.84 - order type at market Just thought that was odd and is therefore throwing off the P/L since it is actually only down .13 on the day ($6.50 for the 50 shares - but the site lists it as -$91) so... Just pointing it out is all Thank you Cheers |

| Kevin_in_GA 4,599 posts msg #112481 - Ignore Kevin_in_GA |

3/27/2013 6:09:28 PM Yeah, no idea why that is but it could turn a profitable trade into a loss. I'll send them a note to see why this happened. |

| mdmink 8 posts msg #112482 - Ignore mdmink |

3/27/2013 6:38:46 PM Firstly, like a lot of other folks around here, I also pass along my thanks for your many contributions on these forums for the past couple years that I have been a member. Your not only prolific in your system development, but thorough and systematic. I've tried a lot of different services over the years; Expensive, moderately expensive, cheap! Found one options service that was regularly successful, but it was rather pricey and sent alerts throughout the day. Many times by the time I got the alert, or had time to take action on it, the window of opportunity had mostly passed. Soon the volume of the alerts and my inability to act on them caused me to drop that service also. Until recently, I was a subscriber to Conners power-ratings. I currently trade a 52-week high pullback system that I use stockfetcher to generate me a list for. It's not really a candidate for backtesting, as it takes some human interaction after the close to determine which stocks to trade the next day. Anyway, yes, an after-the-close kind of alert system for a moderate monthly cost, that had a good track record would be worth it to me, and I suspect, a lot of other folks who want to play golf or pursue other activities during market open hours. |

| Kevin_in_GA 4,599 posts msg #112483 - Ignore Kevin_in_GA |

3/27/2013 8:39:13 PM I figure I'll post a few of the trade selections here for a few days, in case folks want to keep me honest. Given the odd market order entry today on PH, I adjusted the strategy to use limit orders (I had already done this, just in case). Not all will hit obviously, but this way there is a clear number of shares and entry price (I like knowing that I am picking up a good stock on a pullback). The results are actually better even though you are in fewer trades. JPM - 105 shares at 47.30 EXPE - 83 shares at 60.29 MYL - 175 shares at 28.46 |

| Kevin_in_GA 4,599 posts msg #112484 - Ignore Kevin_in_GA |

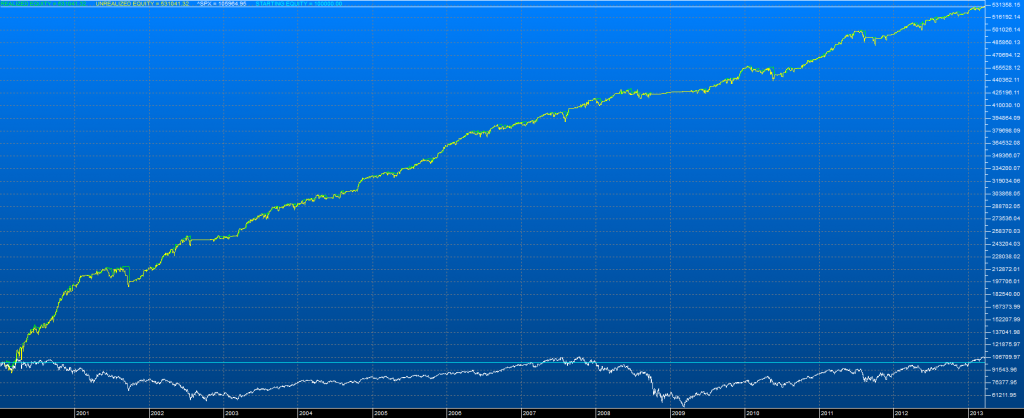

3/27/2013 9:45:59 PM Also had two requests via email for backtest data. Here is the equity curve from 12/31/1999 through last Friday (^SPX in white):

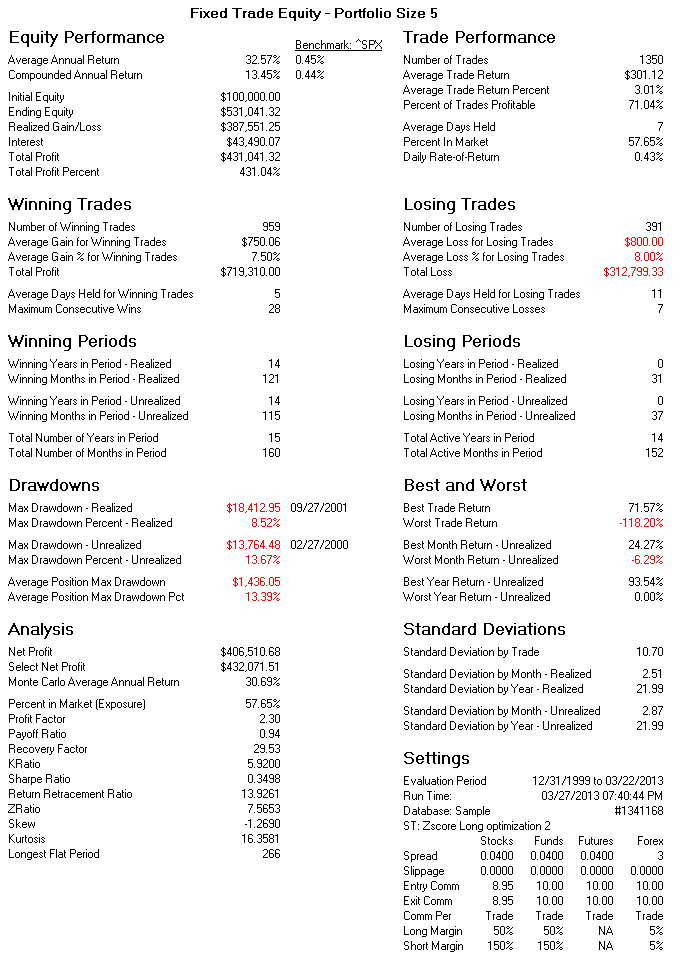

And here are the stats:

The annualized Sharpe ratio for this is 1.21. Also note that these are fixed equity trades, always set at $20,000 and a portfolio size of 5 regardless of total equity. I do this because if one allows for growth of the bets over the same period, the amount of each bet grows rapidly from the initial $20,000 just under $1.1 M. This is too large and would move the price too far against you to make the trade work. Looks great on paper but is never possible in real life. |

| miketranz 956 posts msg #112485 - Ignore miketranz |

3/27/2013 10:21:33 PM Kevin,the equity curve chart is amazing.The stocks you have listed are pullbacks that look like they took out the bottom of a short term trading range.I have a few questions 1)Is this system primarily based on pullback trades? 2) When are you entering the trade,pre open,on open,after open above a certain range? 3)Are there any rules for not entering a trade or are you just executing regardless of conditions? 4)What's your holding time frame or exit rules? 5)How often do stocks to appear on your hit list for this trading system? 6)Is this just part of a larger system or does this one stand alone? I will be following,possibly trading these three you have mentioned.Thanks.Miketranz........ |

| wkloss 231 posts msg #112486 - Ignore wkloss |

3/28/2013 12:09:51 AM novacane32000 I was using it as an example, not necessarily the one I would pick. Bill |

| StockFetcher Forums · General Discussion · Need some input from the forum | << 1 ... 2 3 4 5 6 ... 10 >>Post Follow-up |