| StockFetcher Forums · General Discussion · Personal web page | << 1 ... 4 5 6 7 8 ... 9 >>Post Follow-up |

| Kevin_in_GA 4,599 posts msg #105859 - Ignore Kevin_in_GA |

4/9/2012 9:37:53 AM Yes, the allocations are as you described. As to the frequency of reallocation, that depends on what type of account you have. If it is a standard retirment account, you might only be able to re-allocate once a month. If it is a trading account, you can reallocate more frequently, but you will incur commission costs. And since this is based primarily on ROC, it should default to AGG in the case of a meltdown, but the timing will never get you out ahead of a meltdown. You'll take some reduction of profit (or a loss) before the trigger is hit. No investment system can predict ... it can only respond to the event after it occurs. Hopefully in a timely enough fashion to save your profits. Looking at today's futures, the April allocation will be taking a hit. However, the system is up about 10-11% on the year so far, so a small hit would not be a critical injury. |

| duke56468 683 posts msg #105863 - Ignore duke56468 |

4/9/2012 1:46:49 PM mahkoh.... you can check back and you'll see the filter was %100 in AGG in June-July-August-Sept 2011. My question is timing to go all in the first time, or better to start partial positions. |

| mahkoh 1,065 posts msg #105865 - Ignore mahkoh |

4/9/2012 6:04:41 PM Thanks, Duke. Should have thought of that. |

| Kevin_in_GA 4,599 posts msg #105866 - Ignore Kevin_in_GA |

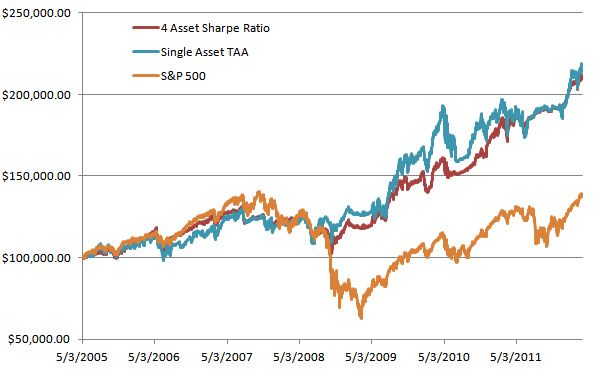

4/9/2012 8:34:40 PM Guys - here is the comparison between the TAA allocation approach (100% in the highest ROC) versus the Sharpe ratio-based allocation. Start date is 5/4/2005 through to 3/30/2012. The Sharpe allocation approach provides essentially the same overall return but with a lower volatility (thus, a higher Sharpe ratio!). Kevin  |

| jldelta 16 posts msg #105868 - Ignore jldelta |

4/10/2012 3:58:10 AM >And since this is based primarily on ROC, it should default to AGG in the case of a meltdown, but the timing will never get you out ahead of a meltdown. You'll take some reduction of profit (or a loss) before the trigger is hit. _____________________________________________________________________________________________ Thanks for the great code, Kevin. I wonder if there is merit in always having some allocation to Bonds - precisely because one can never predict - and it there is a way to do so without significantly denting perfomance ? Something along the lines of having the bond component as a "mini sector rotation" , maybe using FAGIX (offense) / VUSTX (defense) a la Terry Laundry. |

| novacane32000 331 posts msg #105869 - Ignore novacane32000 |

4/10/2012 7:10:58 AM The lower volatility on this last filter is great!! The tendency to want to "follow your gut" instead of the filter is much less when your portfolio has a balance to it. |

| Kevin_in_GA 4,599 posts msg #106003 - Ignore Kevin_in_GA |

4/24/2012 12:03:53 PM I wonder if there is merit in always having some allocation to Bonds - precisely because one can never predict - and it there is a way to do so without significantly denting perfomance ? ++++++++ Not for me. If they act as a drag on performance, you should not be in them. You are making an assumption that the loss of profit by being in bonds when the market is bullish is less than the loss you take if the market truns bad. Maybe, maybe not. By the way, web page has been updated. Look for me to shift from TAA to the Sharpe system on Friday for my personal assets. |

| jldelta 16 posts msg #106006 - Ignore jldelta |

4/25/2012 4:22:30 AM >Look for me to shift from TAA to the Sharpe system on Friday for my personal assets. Good move, especially c/w the old adage "Sell in May & go away..." ! |

| Kevin_in_GA 4,599 posts msg #106007 - Ignore Kevin_in_GA |

4/25/2012 9:12:00 AM The "sell in May" adage has played out for the last two years, but there are plenty of other years where that would not have been the right decision (e.g., 2009). Using risk-adjusted performance avoids guesswork. In fact, if you look at the curves for both TAA and the Sharpe allocation, the move out of equities in the summers of 2010 and 2011 avoided a potential big loss, but the decision was mechanical and based on data rather than gut feeling. |

| Kevin_in_GA 4,599 posts msg #106008 - Ignore Kevin_in_GA |

4/25/2012 1:41:13 PM And as of today, the Sharpe Ratio allocations for May are: SPY - 72% EFA - 17% IWM - 11% AGG - 0% Compared to the current TAA pick for next month - 100% in SPY - there's not a lot of difference from a risk perspective. |

| StockFetcher Forums · General Discussion · Personal web page | << 1 ... 4 5 6 7 8 ... 9 >>Post Follow-up |