| StockFetcher Forums · Stock Picks and Trading · Generic | << 1 ... 45 46 47 48 49 ... 63 >>Post Follow-up |

| four 5,087 posts msg #129570 - Ignore four |

7/3/2016 1:42:21 PM Kevin_in_GA has his ideas about buying the dip http://www.stockfetcher.com/forums2/Filter-Exchange/BUYING-THE-DIP/113409 |

| pthomas215 1,251 posts msg #129572 - Ignore pthomas215 |

7/3/2016 4:42:56 PM thanks. good filters in there. do you see any limitations with this one? |

| four 5,087 posts msg #129573 - Ignore four modified |

7/3/2016 5:03:31 PM The filter is a start... the above you posted has no volume and no price requirements (min/max). Other things to know: 1. per trade dollar amount as percentage of portfolio 2. max # of trades at a time 3. profit point 4. loss point 5. pyramid up / pyramid down 6. entry [market order, limit order, stop-limit order...?] 7. etc... 8. dividend / no dividend 9. blue chip / penny stock 10.etc... 11. diversification by industry 12. what if the filter only returns 4 trades every 3 months on average These above help make a system. You and I have only been dealing with entry! |

| pthomas215 1,251 posts msg #129575 - Ignore pthomas215 |

7/3/2016 6:42:16 PM yes, that is a fair point. eventually I am trying to get to value investing. at this point, I just want to identify the huge spikes before they hit. |

| four 5,087 posts msg #129599 - Ignore four modified |

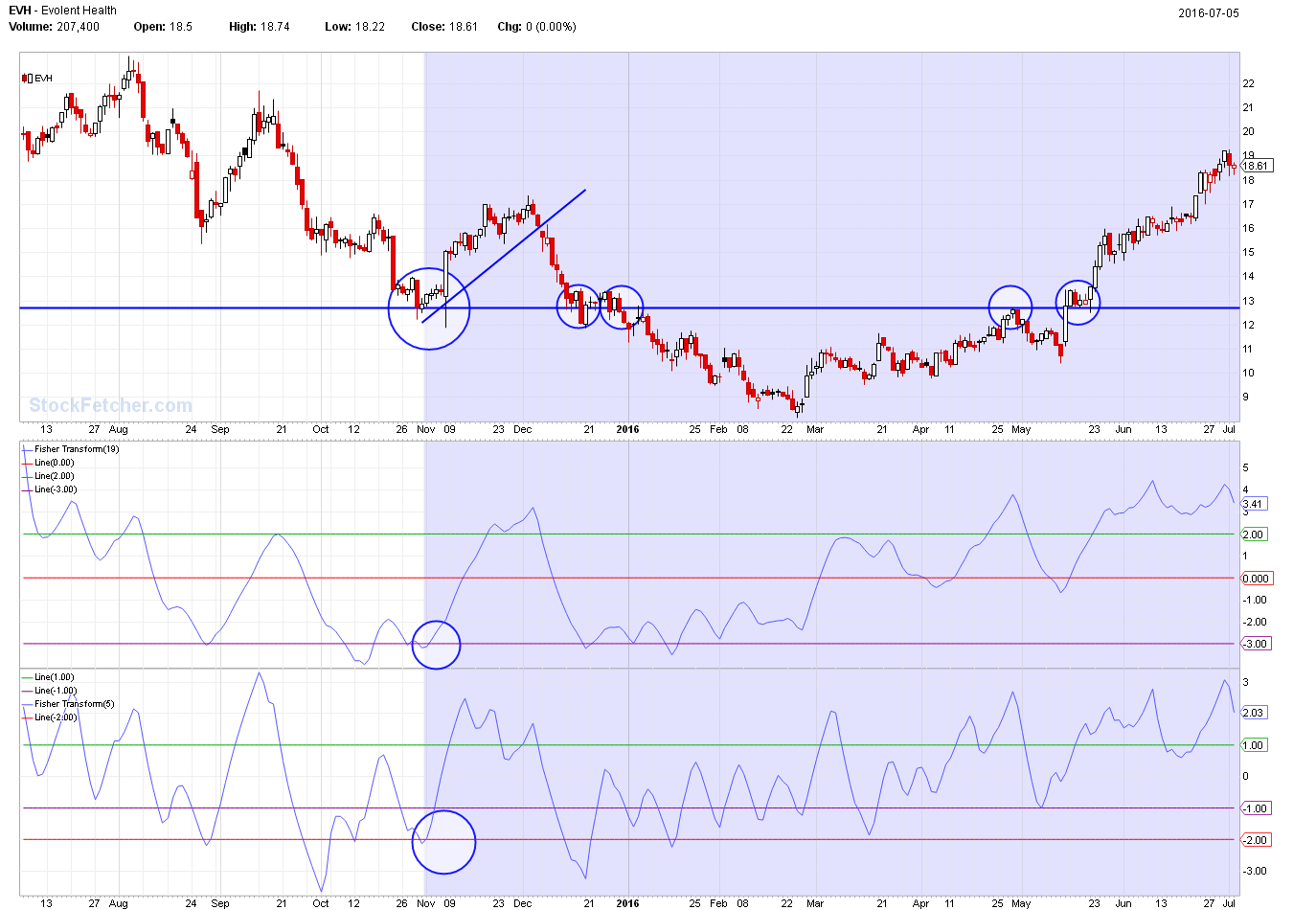

7/5/2016 11:24:43 PM   |

| pthomas215 1,251 posts msg #129600 - Ignore pthomas215 |

7/6/2016 12:13:55 AM four, you are great at idea generation. always great filters to consider. when I looked at the one you posted, if I used "price crossed above 0" it seemed to pull stocks up that had already escalated. what do you think about this one in terms of catching stocks before they escalate? |

| pthomas215 1,251 posts msg #129601 - Ignore pthomas215 |

7/6/2016 12:27:56 AM it seems like from the chart you posted that if (5) crosses above -1, you can go long on it |

| four 5,087 posts msg #129602 - Ignore four modified |

7/6/2016 1:48:25 AM  |

| four 5,087 posts msg #129640 - Ignore four modified |

7/7/2016 9:56:42 AM option  |

| four 5,087 posts msg #129665 - Ignore four |

7/8/2016 12:54:32 AM |

| StockFetcher Forums · Stock Picks and Trading · Generic | << 1 ... 45 46 47 48 49 ... 63 >>Post Follow-up |