| StockFetcher Forums · Stock Picks and Trading · Gold miners | << >>Post Follow-up |

| djones000buck 206 posts msg #119916 - Ignore djones000buck |

5/17/2014 8:27:27 AM Looking like a good spot to add to positions.. Auy, gdx, hmy, abx. |

| four 5,087 posts msg #119972 - Ignore four |

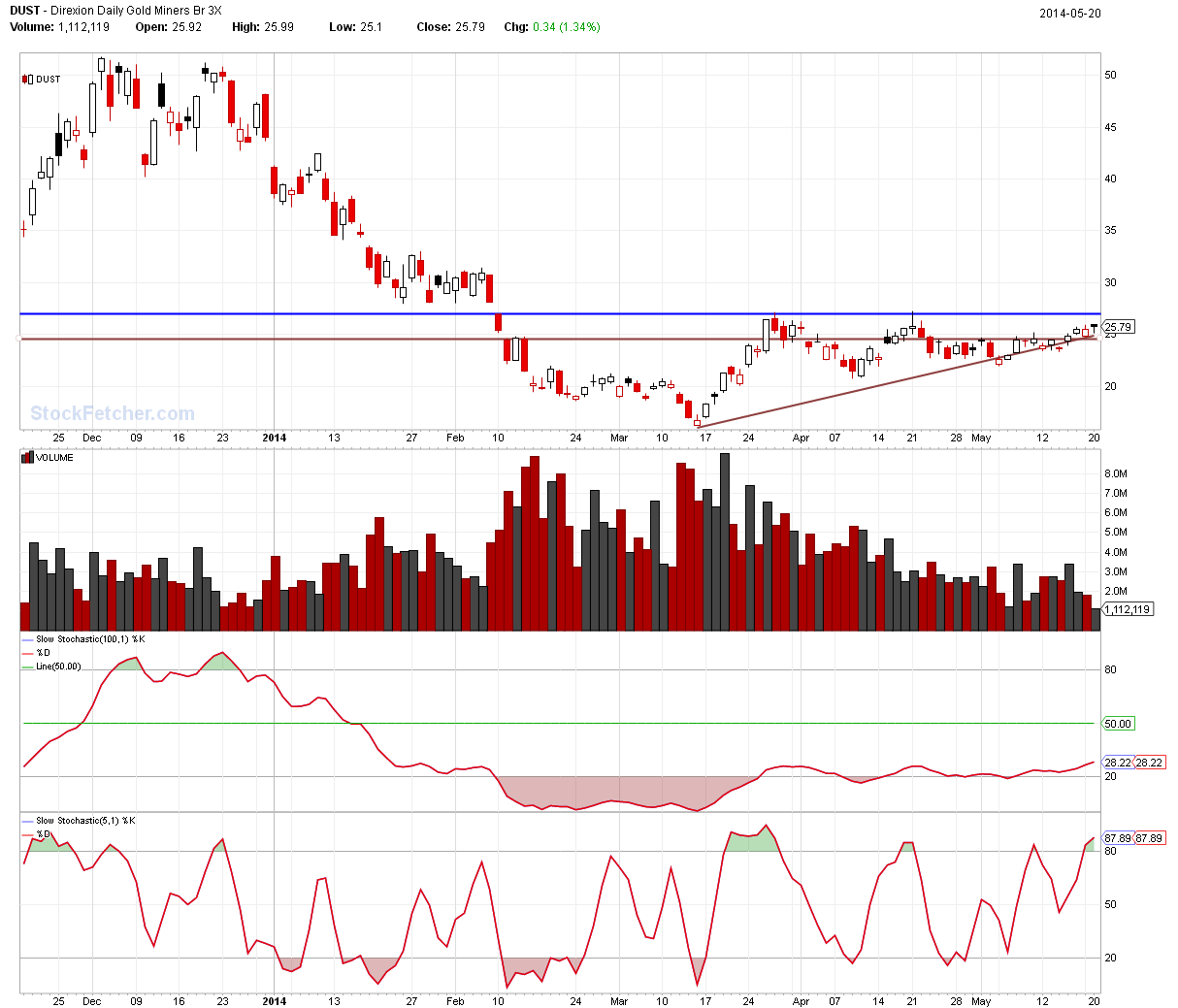

5/20/2014 2:23:58 PM |

| novacane32000 331 posts msg #119976 - Ignore novacane32000 |

5/20/2014 7:34:51 PM I have been buying NEM on dips and selling for a quick profit the last 2 or so months. Has worked real well thus far. |

| djones000buck 206 posts msg #120378 - Ignore djones000buck |

6/3/2014 8:54:49 PM First sign of life showed up gdx,auy,iag... |

| djones000buck 206 posts msg #120381 - Ignore djones000buck |

6/3/2014 10:53:48 PM

confirmation tomorrow, maybe Thursday.. |

| djones000buck 206 posts msg #120382 - Ignore djones000buck modified |

6/3/2014 10:54:55 PM great now have to learn to resize images... it never ends does it :) notice your "a" code Four, been playing around with it a bit...thx for sharing. i found it confirms and/or beats some of my similar triggers, but only on certain stocks.. I also find my timeframes need to be modified every few weeks or so to adjust to the market.. |

| guspenskiy13 976 posts msg #120391 - Ignore guspenskiy13 modified |

6/4/2014 8:59:31 AM I also noticed that GDX is a buy for today, on multiple screens.... Curious to see the action... P.S. Could you show the filter that you used in your screenshot? It looks interesting... Thanks |

| johnpaulca 12,036 posts msg #120394 - Ignore johnpaulca |

6/4/2014 9:14:58 AM GG($22.82)....this is the most oversold of the bunch |

| djones000buck 206 posts msg #120464 - Ignore djones000buck |

6/4/2014 5:04:03 PM Sure, tried to clean it up a bit... Busy chart but tried to comment some rationale, I don't display all the trigger events typically, but you get the picture.. |

| guspenskiy13 976 posts msg #120466 - Ignore guspenskiy13 |

6/4/2014 6:15:03 PM Thanks for posting, I appreciate it. |

| StockFetcher Forums · Stock Picks and Trading · Gold miners | << >>Post Follow-up |