| StockFetcher Forums · General Discussion · Swing Trading Ideas and methods | << 1 ... 89 90 91 92 93 ... 99 >>Post Follow-up |

| four 5,087 posts msg #107533 - Ignore four modified |

8/10/2012 3:56:33 PM GORO in at 18.76 a while back (Aug8) |

| Eman93 4,750 posts msg #107535 - Ignore Eman93 |

8/10/2012 5:44:26 PM Nice! |

| novacane32000 331 posts msg #107545 - Ignore novacane32000 modified |

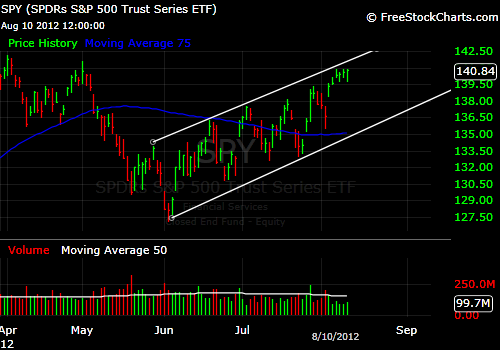

8/12/2012 9:48:04 AM Would you guys interpret this daily SPY chart as a tight flag ready to breakout higher or the top of channel ready to move lower?  |

| Cheese 1,374 posts msg #107548 - Ignore Cheese |

8/12/2012 3:46:51 PM Thomas Bulkowski's prediction for the week of Aug 13, 2012 http://thepatternsite.com/Blog.html#P13 |

| novacane32000 331 posts msg #107549 - Ignore novacane32000 modified |

8/12/2012 4:00:49 PM Cheese- Thats a great site and I just happen to have discovered it a couple of months ago. I have started to track his weekly predictions but as Thomas states , his signals can change.In other words he will backtrack and change a buy to sell and visa versa as patterns develop. Regardless ,the man has done his homework and has a wealth of info to share. He is bullish for this week. |

| johnpaulca 12,036 posts msg #107550 - Ignore johnpaulca |

8/12/2012 4:24:28 PM Weekly charts pointing towards a move higher. |

| Eman93 4,750 posts msg #107551 - Ignore Eman93 |

8/12/2012 5:01:48 PM good question! really no way to tell for sure until it happens.... we did put in an engulfing candle Friday (bearish). Daily and hourly are overbought, SPX at horz resistance 1404. and close to channel resistance VIX is extremely low Long term signals are on BUY.. 20ma above 50ma above the 200ma. so we should be looking to go long only at this point.. "the trend is your friend" Breakouts on oversold conditions, as the bulls overwhelm the bears, are explosive and if we do gap high enough, that could trigger a wave of stops being hit causing a spike or gap and go. My trading plan for next week is to buy RUT above Fridays high with a close below 800 as a stop loss... if we have a gap up I will wait for it to fill the gap to enter long... if that fails to hold I will switch and go short below 800 only if the USD is above 82.60 If we gap down.. I will short at the gap fill or 802 but still want the dollar to hold 82.60 Still need to be mindful of this chart: http://stockcharts.com/public/1424685/chartbook/239120039; it is at resistance below the 50 and 20 (bearish).. it is looking like another leg down.. hence why JP is in GLD... Its kind of a mixed bag... Ideally you would want the the USD chart at support and the SPX at resistance to go short. 82.60 the number to watch on the USD. The USD at resistance and SPX at resistance tends to make me think a break out will happen. |

| Eman93 4,750 posts msg #107604 - Ignore Eman93 |

8/14/2012 1:34:31 AM SDS hit today by rule buy at the open and hold for 2 days and sell.... I wont short unless the dolla reclaims 82.60 and SPX drops bellow 1404. |

| Eman93 4,750 posts msg #107605 - Ignore Eman93 |

8/14/2012 1:36:34 AM http://stockcharts.com/public/1107832/chartbook/250395735; |

| four 5,087 posts msg #107642 - Ignore four modified |

8/15/2012 9:53:17 AM 8/10/2012 3:56:33 PM GORO in at 18.76 a while back (Aug8) *---- 8/15/12 = holding |

| StockFetcher Forums · General Discussion · Swing Trading Ideas and methods | << 1 ... 89 90 91 92 93 ... 99 >>Post Follow-up |