God99

1 posts

msg #160709

- Ignore God99

modified |

12/11/2023 1:15:08 PM

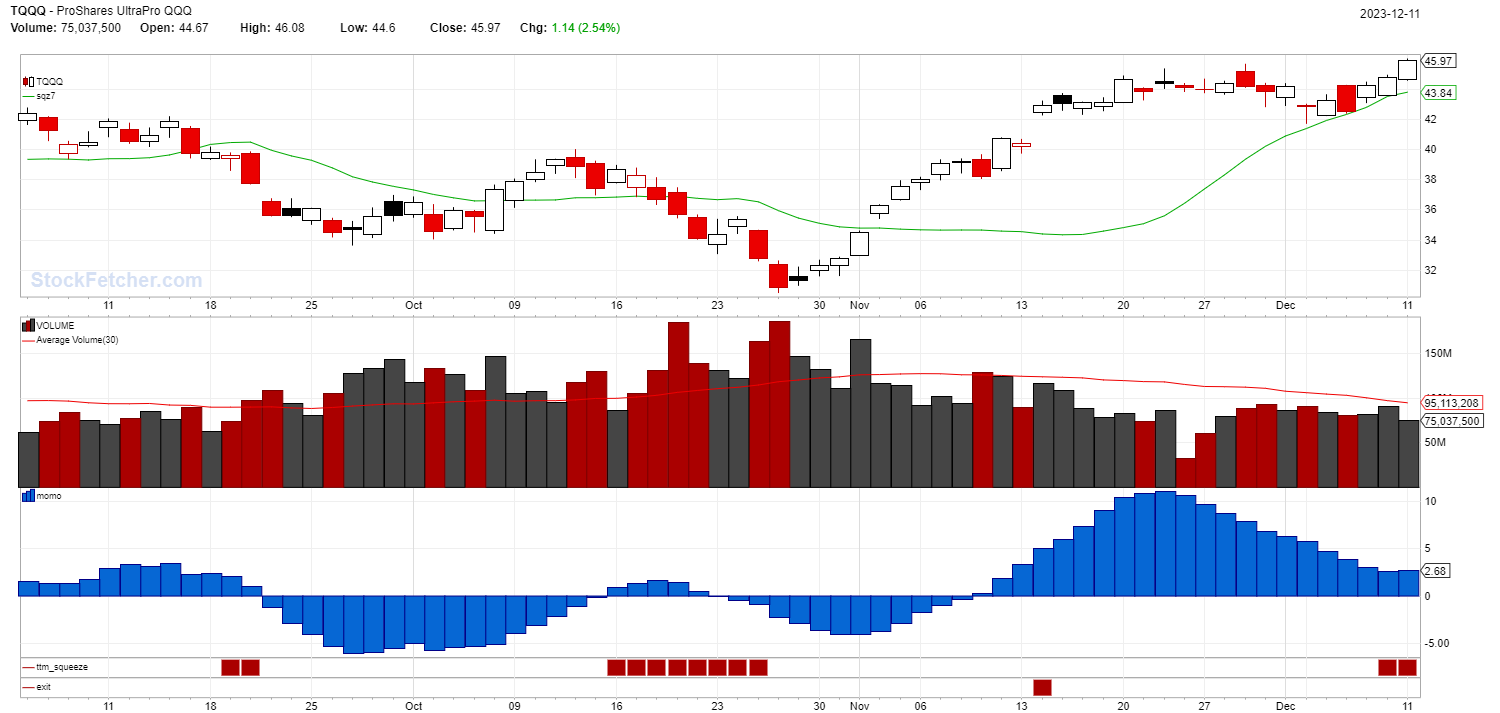

For those how like to trade the TTM Squeeze, this filter will search stock that are in squeeze and have a bullish momentum switch:

|

xarlor

638 posts

msg #160711

- Ignore xarlor |

12/11/2023 1:56:37 PM

I'm a big fan of the TTM Squeeze. I like your bullish momentum switch too.

What are your exit rules? I added an exit rule below of the close being above both the Upper Bollinger and Upper Keltner. Great for swing trades if you don't want the extended ride.

|

snappyfrog

749 posts

msg #160712

- Ignore snappyfrog

modified |

12/11/2023 6:39:26 PM

The calculation is not right on the following line as it does 2 functions.

set {sqz7,(Lower Bollinger Band (20,2) + Upper Keltner Band (20,2)) /2}

So I made it 2 lines as follows:

set {sqz7a,(Lower Bollinger Band (20,2) + Upper Keltner Band (20,2))}

set {sqz7, sqz7a / 2}

It doesn't change it much really.

|

snappyfrog

749 posts

msg #160713

- Ignore snappyfrog |

12/11/2023 6:42:12 PM

|

snappyfrog

749 posts

msg #160714

- Ignore snappyfrog |

12/11/2023 6:48:20 PM

I was playing around with it to see if close above sqz7 plotted on price chart could be useful for entries.

|