| StockFetcher Forums · Stock Picks and Trading · not generic | << 1 2 3 4 5 ... 15 >>Post Follow-up |

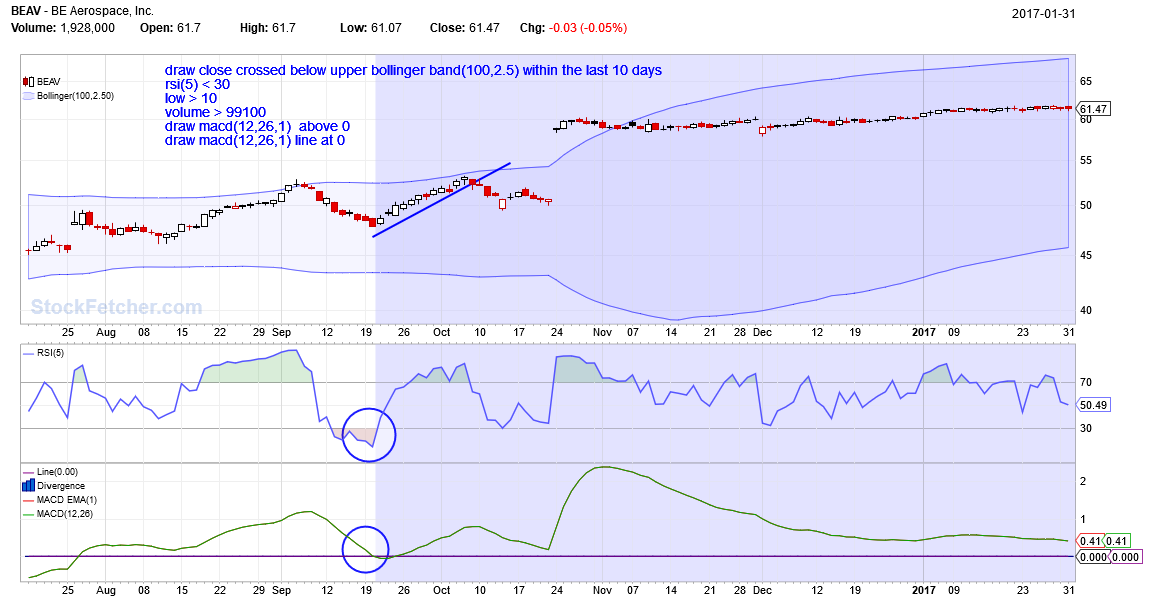

| four 5,087 posts msg #134000 - Ignore four modified |

1/31/2017 10:59:58 PM  |

| four 5,087 posts msg #134002 - Ignore four |

2/1/2017 2:34:04 PM |

| four 5,087 posts msg #134007 - Ignore four |

2/1/2017 11:35:23 PM |

| four 5,087 posts msg #134042 - Ignore four modified |

2/3/2017 8:56:42 PM      |

| four 5,087 posts msg #134044 - Ignore four |

2/4/2017 12:40:37 AM |

| four 5,087 posts msg #134061 - Ignore four |

2/5/2017 1:44:33 PM http://greenonthescreen.blogspot.com/2007/03/filters-i-use.html "ones that have pulled back into what we refer to in the chat as the MZ (muddy zone).This is the zone of the ema13/sma20." http://www.stockfetcher.com/forums2/General-Discussion/Best-Time-of-Day-for-Stock-or-ETF-Entry/134048 "EMA(13) guide you" Thought I would play with EMA(13) since you both mention it. Here is the result...   |

| four 5,087 posts msg #134064 - Ignore four modified |

2/5/2017 2:02:48 PM Ignore above [msg #134061]. Use this filter. Accuracy is better. Remove min and max statements and replaced with two statements instead of 1 each, http://greenonthescreen.blogspot.com/2007/03/filters-i-use.html "ones that have pulled back into what we refer to in the chat as the MZ (muddy zone).This is the zone of the ema13/sma20." http://www.stockfetcher.com/forums2/General-Discussion/Best-Time-of-Day-for-Stock-or-ETF-Entry/134048 "EMA(13) guide you" Thought I would play with EMA(13) since you both mention it. http://filteringwallstreet.blogspot.com/ Likes a crossover "4, 8 and 21 EMA" -- 4+8 is almost 13 AND 21 is almost 20 Here is the result...   |

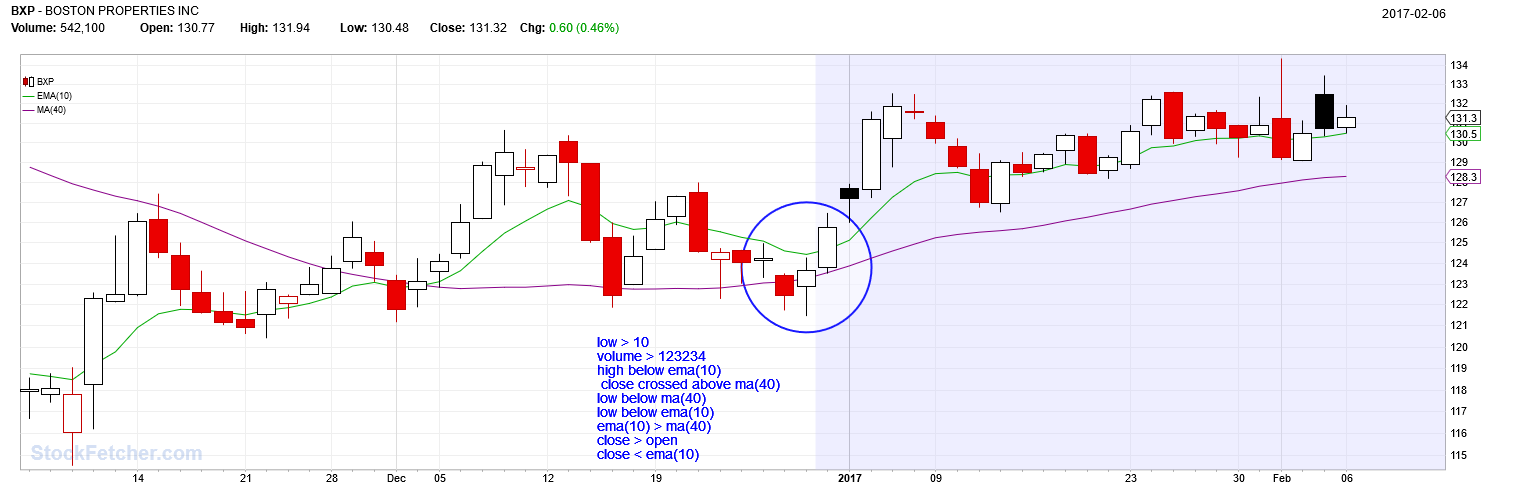

| four 5,087 posts msg #134088 - Ignore four modified |

2/7/2017 12:02:55 AM   |

| four 5,087 posts msg #134155 - Ignore four modified |

2/9/2017 10:25:29 AM  |

| four 5,087 posts msg #134166 - Ignore four |

2/9/2017 12:30:17 PM  |

| StockFetcher Forums · Stock Picks and Trading · not generic | << 1 2 3 4 5 ... 15 >>Post Follow-up |