| StockFetcher Forums · Filter Exchange · NEW SYSTEM WITH INTEGRATED 5% STOP LOSS | << 1 2 3 4 5 >>Post Follow-up |

| Kevin_in_GA 4,599 posts msg #112177 - Ignore Kevin_in_GA modified |

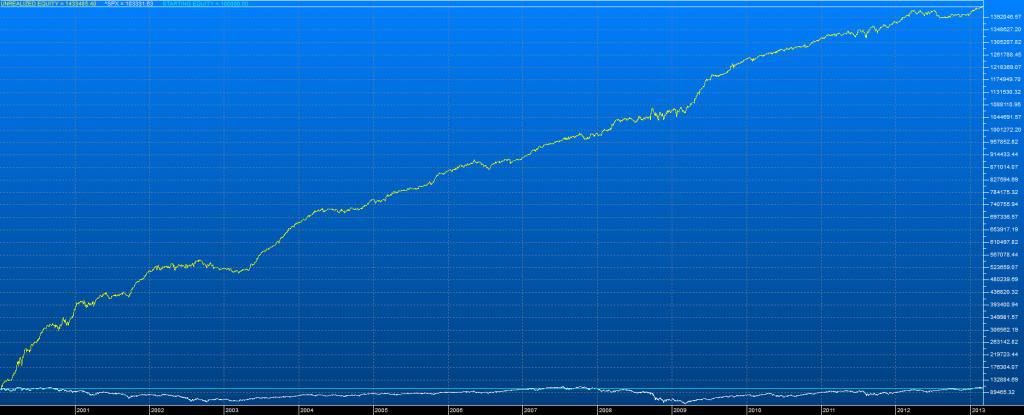

3/11/2013 9:54:51 PM This thread is a continuation of the ConnorsRSI thread found here: http://forums.stockfetcher.com/sfforums/?q=view&fid=1001&tid=108942&qrid= I have looked at variations incorporating stop losses into the filter I posted there, which was loosely based on Connors system. I had modified it to remove his proprietary ConnorsRSI indicator and basically changed most of his preferred settings. In most "catch a falling knife" systems like these, stop losses are of potential benefit, but tend to limit overall performance. I decided to really test if inclusion of stop losses into the filter would really result in poorer performance. The answer was both yes and no. Yes, in that it did result in lower returns, lower percent wins, and a lower Sharpe ratio. And No, because one could accept a smaller return if one got a higher number of trades to fill the gaps. The higher frequency more than makes up in profit for smaller percent gains, and the overall Sharpe ratio can be retained at a decent value. Here is the original filter: Entry is on a further 6% pullback tomorrow. Exit is RSI(2) > 50. This filter did well until the start of this year, when it ran into low trade frequency and some serious drawdowns on a few trades. I choose to exclude etfs since the most damage came from the triple leveraged versions. Without laboring through a detailed description of the system development process, here is the version I think provides a good balance between return and reduced drawdowns: Entry is on a further 6% pullback tomorrow. Exit is at RSI(2) > 40 OR a 5% stop loss triggered. Performance Metrics from 12/31/1999 until 3/8/2013: Number of potential trades: 25,981 Number of trades entered: 4,096 Win percentage: 60.74% Average trade return: 2.20% Average Days in Trade: 3 Annualized Sharpe Ratio: 1.278 Monte Carlo Av. Annualized Return: 136.13% I ran several thousand random combinations of trade entries and found the "typical" annual return to be more like 85%. Note that this is a lower win %, lower MC annual return, and a lower Sharpe ratio. But ... still some VERY solid results with a higher "peace of mind" factor. Here is the equity curve for this system (one of the randomized entries, but representative of the system performance). The white line at the bottom is the performance of the S&P 500 over the same period:

This is a fully developed and thoroughly back-tested system. I will not further evaluate this one. I leave that up to others here. Enjoy and adapt it to your needs. |

| tennisplayer2 210 posts msg #112190 - Ignore tennisplayer2 |

3/12/2013 12:17:34 PM AVG trigger today.@12.80 |

| novacane32000 331 posts msg #112198 - Ignore novacane32000 |

3/12/2013 8:58:58 PM Kevin The eqiuty curve doesnt show much of a drawdown. What was the max drawdown for the time period tested?. Also, how many consecutive losses did the system have. |

| Kevin_in_GA 4,599 posts msg #112199 - Ignore Kevin_in_GA |

3/12/2013 9:40:50 PM Maximum drawdown was 13.74% but was slightly over $28,000. Note that the final return on your initial $100,000 was $1,227,471 (portfolio size of 5, fixed size of $20,000 per trade). Max consecutive losses for this chart was 10. Percent in market was 76% (meaning that on average you were in 3-4 trades at any time, the rest in cash). |

| dcsnowden 52 posts msg #112202 - Ignore dcsnowden |

3/12/2013 11:36:03 PM K. I've noticed that the [ close is below day position(0.2,1) ] line of text has been removed...why was this? I thought that was an integral part of the logic behind the filter....a weak day, culminating in a weak close...followed by another that hopefully triggers the buy and then rebounds back to some not-so-oversold mean price. Is the low rsi(2) value phrase meant to replace the short term weakness...the "Market Mentality" sought after by the original phrasing? Just curious as to why you found this necessary, just to incorporate a 5% stop loss feature. THX.....DCS |

| tennisplayer2 210 posts msg #112203 - Ignore tennisplayer2 |

3/13/2013 12:00:14 AM Kevin, Is the exit whenever rsi(2) >40 or is that the trigger to exit the next day's open? Thanks. |

| Kevin_in_GA 4,599 posts msg #112206 - Ignore Kevin_in_GA |

3/13/2013 9:43:11 AM All exits are based on EOD data and are at the open of the next day. |

| Kevin_in_GA 4,599 posts msg #112207 - Ignore Kevin_in_GA |

3/13/2013 10:18:18 AM K. I've noticed that the [ close is below day position(0.2,1) ] line of text has been removed...why was this? I thought that was an integral part of the logic behind the filter....a weak day, culminating in a weak close...followed by another that hopefully triggers the buy and then rebounds back to some not-so-oversold mean price. Is the low rsi(2) value phrase meant to replace the short term weakness...the "Market Mentality" sought after by the original phrasing? Just curious as to why you found this necessary, just to incorporate a 5% stop loss feature. THX.....DCS I ran two optimizations, one with and one without this requirement. It did better and generated more trades without it. I added in the low RSI(2) to make sure that trades were selected where the RSI(2) on the first pullback was at least below the RSI(2) based exit. It ends up that it also adds to overall profitability (not really to win%) with fewer trades. This is now so far from the original Connors criteria that I no longer think referring to that makes much sense. That is why I just titled this thread "NEW SYSTEM". |

| Kevin_in_GA 4,599 posts msg #112208 - Ignore Kevin_in_GA modified |

3/13/2013 10:33:43 AM tennisplayer2 104 posts msg #112190 - Ignore tennisplayer2 3/12/2013 12:17:34 PM AVG trigger today.@12.80 +++++++++++++++++++++++ Using the following filter here are the trades entered yesterday: From yesterday it looks like 1 trade was entered: AVG - 1562 shares at $12.80 UPDATE: 5% stop loss hit today at $12.16 (low so far for today was $12.11) and for today we see NTWK - 1818 shares at $11.00 (currently at $11.09) |

| johnpburke 3 posts msg #112209 - Ignore johnpburke |

3/13/2013 11:23:43 AM Kevin, perhaps I am doing something wrong. AVG is the only stock that I saw trigger yesterday. Also, out of the 53 stocks that were on the watch list for today for the further 6% pullback, none of the 4 you mentioned that triggered today were on my list to watch for today. I ran your filter last night a few hours after market closed to get the 53 stocks that were potential buys for today. Although I don't know what I am doing wrong, I assume that I am doing something wrong (wouldn't be the first time). Anyone else have the same results as me for the last 2 days? |

| StockFetcher Forums · Filter Exchange · NEW SYSTEM WITH INTEGRATED 5% STOP LOSS | << 1 2 3 4 5 >>Post Follow-up |